Hosted by

Carl Seidman CPA | Microsoft MVP

The person Fortune 500s use for their financial leadership development programs

4.9 (82 Ratings) · 3 Weeks · Cohort-based Course

Hosted by

Carl Seidman CPA | Microsoft MVP

Partial List of Current & Former Clients

Course Overview

It’s vital to understand the finances of your business, the causes of cash bleeding, and remedies for improving working capital.

In this program — the 2nd highest-rated corporate finance course on Maven (behind Carl Seidman’s Advanced Financial and Business Modeling) — attendees will discover the various causes of cash flow constraints and how to address them, learn the step-by-step process for building a direct approach 13-week cash flow forecast model, and integrate it with a longer-term financial forecast.

This program is geared toward professionals in corporate finance, private equity (PE), financial planning & analysis (FP&A), turnaround and restructuring, and distressed investing.

Don’t wait for cash flow challenges to arise. The time to learn how to manage them is now.

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.NASBARegistry.org.

Seidman Financial is a division of Seidman Global LLC.

Tue 10/21 9:00 AM—11:00 AM (CDT)

📄 Course File Review (Complete by Dec 8)

📄 Direct vs. Indirect Cash Flows (Complete by Dec 8)

📄 Cash Flow Modeling Best Practices | Structure (Complete by Dec 9)

📄 Cash Flow Modeling Best Practices | Contents and Formulas (Complete by Dec 9)

📄 Cash Flow Modeling Best Practices | Quality Review and Presentation (Complete by Dec 9)

📄 Structuring the Cash Flow Forecast Model (Complete by Dec 9)

📄 Getting the Timing Right: Accrual vs. Cash (Complete by Dec 9)

📄 How the Financial Statements Connect and Relate (Complete by Dec 9)

📄 Introduction to the Business Case (Complete by Dec 9)

📄 Sourcing information from reports, statements and data

Fri 10/24 9:00 AM—11:00 AM (CDT)

📄 Modeling Sales and Cash Collections (Complete by Dec 9)

✍️ Build Your Own Sales and Collections Forecast (Submit by Dec 9)

Tue 10/28 9:00 AM—11:00 AM (CDT)

📄 Modeling Payroll, Benefits, Payroll Taxes, and Layoffs

📄 Modeling Direct Costs and Payments

📄 Modeling Inventory Categories

📄 Advanced Inventory Modeling (Raw Material | Work in Progress | Finished Goods)

📄 Modeling Direct Costs and Accounts Payable (A/P)

📄 Modeling Prepaid and Accrued Expenses

Fri 10/31 9:00 AM—11:00 AM (CDT)

📄 Modeling Indirect Operating Expenses

📄 Modeling Debt and Equity

📄 Modeling Capex / Fixed Assets

📄 Modeling Professional Fees

Tue 11/4 9:00 AM—11:00 AM (CDT)

📄 Modeling Financing Strategy with Excess Cash and Cash Flow Surpluses

📄 Modeling Financing Strategy with Cash Constraints and Cash Flow Deficits

📄 Modeling the Borrowing Base and Available Collateral for Short-Debt Financing

📄 Modeling the Revolving Line of Credit (LOC), Cash Needs, and Borrowing Base

📄 The Completed Cash Flow Model

Fri 11/7 9:00 AM—10:00 AM (CDT)

📄 Modeling Operating Improvements and Changes to Working Capital

📄 Reorganizing and Revitalizing the Business

📄 Reconciling Profitability to Cash (EBITDA-to-Cash Bridge)

📄 Integrations and Nuances in the Timing of Cash Flows

📄 13-Week Cash Flows, DIP Budgets, and Bankruptcy

✍️ Build Your 13-Week Cash Flow Model for Your Company or Client (Submit by Oct 18)

✍️ Capstone Case: Cash Flow Forecasting and Modeling Submit by May 30

📄 Complete the course feedback survey

📄 Book a Call

📄 Articles, Blogs, and White Papers

Carl serves as a Fractional CFO, FP&A advisor, and management consultant to entrepreneurial businesses throughout North America and Europe and assists them with strategic financial planning, value enhancement, and revitalization.

He is a Microsoft MVP and one of the preeminent trainers and facilitators in strategic finance and FP&A, with more than 13,000 participants attending his financial training programs, seminars, workshops, and masterminds. Notable clients include:

ABM Industries, Accordion, AlixPartners, Allscripts, Broadridge, CHEP, Choice Hotels, CIBC, Cigna, Cox Enterprises, Crawford & Company, Deloitte, Dexcom, Discover, Dominium, Express Scripts, EY, FS Investments, EVRAZ, Genentech, Healthpeak, Heartland Financial, Hewlett Packard Enterprise, Hostess, IGT, KPMG, Marsh & McLennan, Michelin, NerdWallet, Radisson, Rapid7, Sol Petroleum, Spotify, Triple-S, Telus, Santander, United Technologies (RTX), UBT, Verizon, Walmart, and Workday.

Carl is masterful at making the complex amazingly simple, engaging his audiences, building confidence, and facilitating a welcoming and transformative group experience. His content is rich and relatable, used in financial leadership development programs (FLDPs) at Fortune 500 companies, and is utilized or licensed by 7 of the top global financial training companies.

Carl serves as an Adjunct Professor in data analytics at the Jones School of Business at Rice University. He is a Certified Public Accountant (CPA) has earned other professional credentials including the CIRA, CFF, CFE, CGMA, AM (Accredited Member in Business Valuation), CSP (Certified Speaking Professional), Certified Anaplan Model Builder, and was a National Association of Certified Valuators and Analysts (NACVA) 40 Under Forty honoree. He holds a BA in finance and economics and an MS in managerial accounting.

He’s been where you want to be and does the work you want to do.

You are strongly encouraged not to miss live sessions, as a great part of the experience is both the live-reveals and the participant interaction.

In other words, you get to:

Yes, sessions are recorded and you can go through them on your own, but learning may be more limited.

We meet for 5 weeks, 4 hours each session. It is intentionally spaced out over a number of days and weeks so you can work your schedule around it.

That’s 20 hours all in: content, discussion, reflection, cases, and Q&A.

There is occasional pre-work and post-session work but it is minimal.

It is not customary for me to offer refunds. Across hundreds of training, seminars, workshops, and conferences — in person and virtual — to thousands of people, I have never been asked once for a refund.

For one in-person training program, there was a blizzard and my flight was canceled. I offered a rescheduling option for a future date.

I offer more than a dozen training programs and immersive development experiences across a wide range of finance and accounting topics.

Here are the other programs I offer in partnership with Maven.

This program is designed for finance professionals who want to advance their skills and understanding specifically in cash flow forecasting.

We meet live on Zoom for 4.5 hours 2x per week.

Each session consists of half the modules of the course. Each module ties into prior and future modules, so it is vital to try to avoid missing classes.

The structure of the session begins with an intro, a tie-in to a real example, exercises, discussion, and reflections.

Prerequisites for the course include the following:

No, but I will offer you my promises.

Everyone who attends this course will have different backgrounds, experience, and aspirations which means they have different business models or jobs.

My promise is to share with you my techniques, tools, and processes that will accelerate your finance career and make you far more confident in what you do.

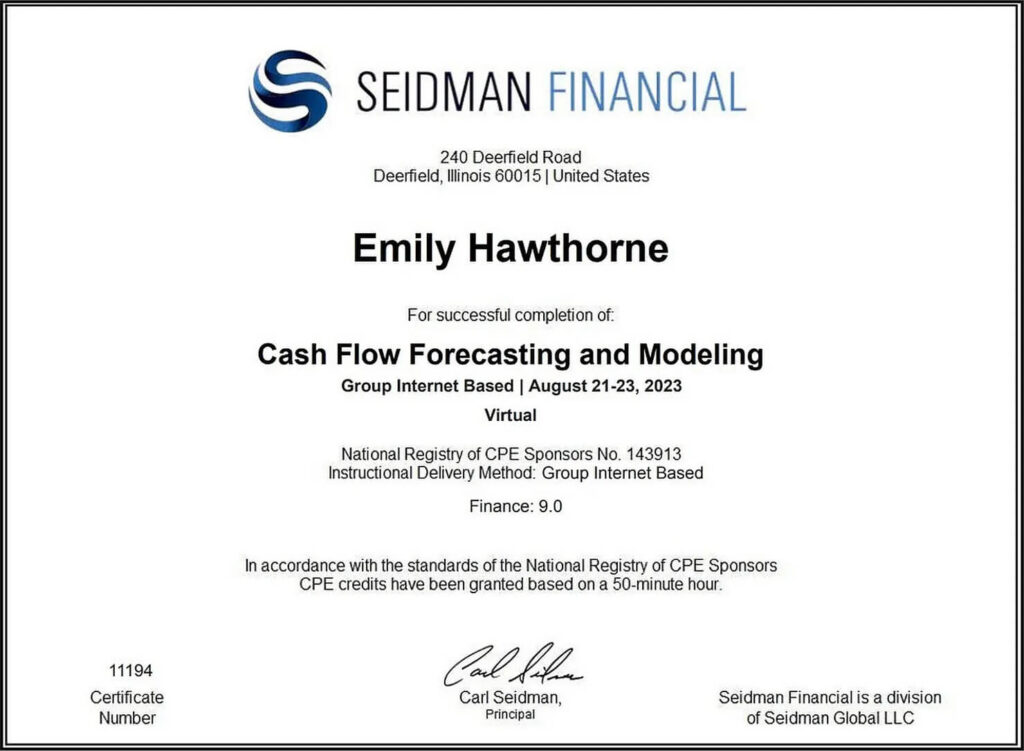

Yes, it qualifies for 9.0 CPE credits.

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit.

Yes. You get all of the template models, clean and completed.

Most on-demand courses teach steps for plugging numbers into a basic model. They don’t teach the nuances that you’re likely to encounter across a wide range of instances. And most cash flow forecasting trainers don’t come from FP&A and CFO backgrounds.

According to alumni, this is the best cash flow forecasting and modeling course available.

Discount Applied Successfully!

Your savings have been added to the cart.