Hosted by

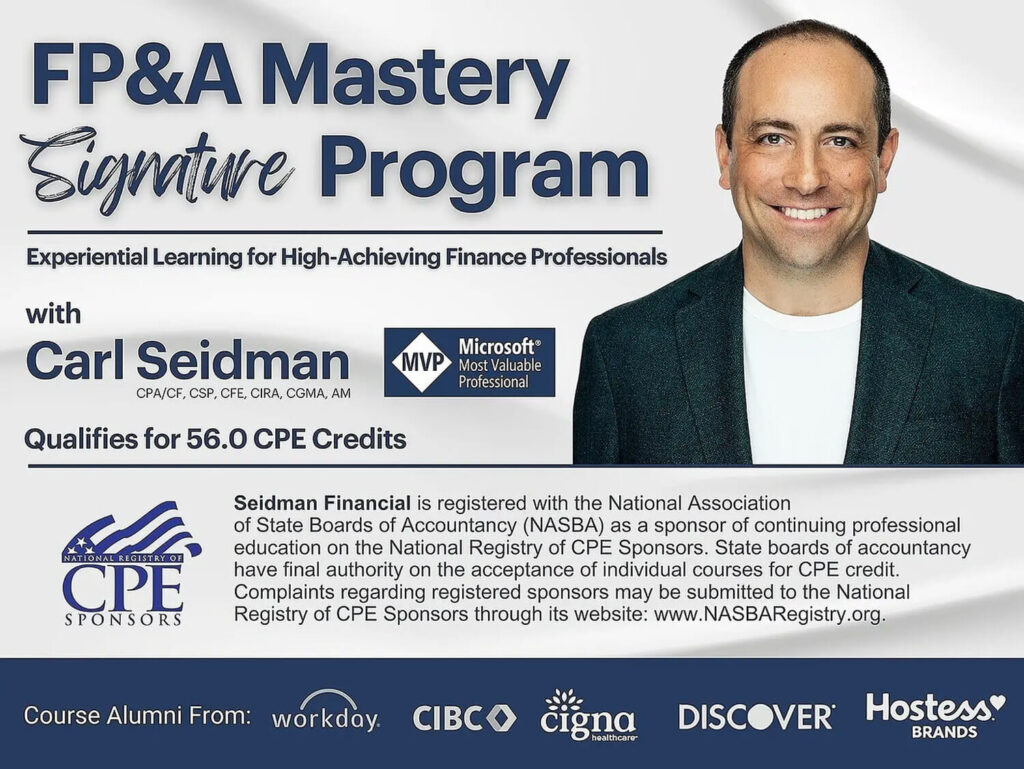

Carl Seidman CPA | Microsoft MVP

The person Fortune 500s use for their financial leadership development programs

NEW · 12-Month Membership

Hosted by

Carl Seidman CPA | Microsoft MVP

Partial List of Current & Former Clients

Program Overview

FP&A mastery is the ability to make good, defensible judgments about finance-related decisions, even in the face of high stakes and ambiguity. Leaders who exemplify FP&A mastery skills work at amazing corporations and rapidly-growing entrepreneurial companies.

A common misconception around these finance skills is that they’re something you either have or you don’t and they take many years to attain.

…but that’s not true.

In reality, you can significantly improve your financial planning & analysis (FP&A) influence + critical and strategic thinking ability by reframing your mindset and mastering a handful of core skills: business modeling, financial analysis, empathy and partnership, and effective communication.

The best FP&A professionals don’t think like analysts. They think like advisors. They’re higher-level thinkers. They understand how their insights connect to what others care about. And they’re masterful communicators. They don’t refer to themselves as masters, but they’re always in pursuit of mastery.

People who level up their FP&A technical and non-technical ability tend to get selected for better projects that are more interesting and challenging than those their peers get assigned to. Directors know these exceptional people can handle it and shine. When they succeed, they’re more likely to get promotions, higher pay, and even more exciting opportunities. Work is far more enjoyable and less frustrating because they’re now more capable, confident, and positive. This leads to a more inspiring career and a fulfilling life.

Influence through finance is a skill that can be rapidly developed by changing how you think through learning, application, practice, and ongoing support. This isn’t wishful thinking. This is reality for those who are committed to their own growth.

This year-long membership gives you full access to weekly live, virtual courses and the complete library of module recordings, immersing you in the frameworks and techniques used by high-performing corporate finance practitioners. Through real-world examples, exercises, templates, models, discussions, and hands-on implementation, you’ll evaluate financial models, Excel techniques, analyses, reports, and dashboards to understand what makes them exceptional (or not). Each session challenges you to think more deeply about finance, modeling, influence, and communication—helping you elevate not just your technical skill set, but the way you think about and approach your work all year long.

* Each series is also available as a standalone course. If you are interested in an individual course, click the button below.

Choose the level of access that aligns with your goals. Core Access delivers 12 months of on-demand recordings for all 8 series, plus downloadable templates and future updates—ideal for independent, self-paced learners or those with conflicting calendars or time zones.

Professional Access includes everything in Core, plus guaranteed seats in live virtual classes, extended Q&A sessions, networking events, and CPE credits for live participation.

For those seeking direct support and implementation, Inner Circle Access provides our most comprehensive experience—adding 1:1 coaching, proprietary tools and models, priority referrals, a LinkedIn credential + digital badge, and a capstone case or company-specific project review with written feedback.

Individual courses will immerse you in the content of that single learning experience. The Signature Program gives you access to EVERYTHING across the full learning ecosystem:

*Benefits are dependent on membership level. See pricing tiers for details.

Since 2013, Seidman Financial has delivered hundreds of financial programs, workshops, strategic advisory sessions, and LinkedIn Learning courses to over 145,000 FP&A professionals from 25+ industries worldwide. Companies that have enrolled financial analysts, managers, and directors include:

ABM Industries, Accordion, Allscripts, Capitol Broadcasting, CHEP, Choice Hotels, CIBC, Cigna, Cox Enterprises, Crawford & Company, The U.S. Department of Housing and Urban Development, Discover, Energy Transfer, Erie Insurance, EVRAZ, Express Scripts, FS Investments, Genentech, Guy Carpenter, HCPI, Heartland Financial, HP Enterprise, Hormel, Hostess Brands, IGT, Marsh & McLennan, Merck, Michelin, NerdWallet, Outsystems, Rapid7, Rice University, Riveron, Santander, Sloan Valve, Sol Petroleum, Spotify, Telus, Triple-S, UBT, United Technologies, The University of Wisconsin-Madison, Verizon, Walmart, and Workday.

The curriculum in the FP&A Mastery Signature Program has been a cornerstone of FP&A training and financial leadership development at dozens of Fortune 500s, mid-market companies, and small entrepreneurial businesses.

The FP&A Mastery Signature Program isn’t for everyone – it is for growth-focused finance professionals dedicated to reaching their next level of technical capability, communication, confidence, and success. They seek a higher level of enablement, empowerment, and assurance which can only be possible through longer-term commitment and community. The program is exclusively available to finance and accounting professions who meet the following criteria:

If you are eligible, tap into this community of like-minded high-achievers committed to your success. Immerse yourself in technical and non-technical development designed to change how you think and support you in reaching your next level of growth.

For companies with multiple attendees, group rate waivers are available.

2026 – 2027 | Professional-Level Membership

Cash Flow Forecasting & Modeling – Level 1

6 sessions 5/1 – 6/12

CFF&M – Level 1

6 sessions 5/1 – 6/12

Budgeting & Rolling Forecasts

6 sessions 6/15 – 7/20

Data Management

6 sessions 6/19 – 7/24

Budgeting & Rolling Forecasts

6 sessions 6/15 – 7/20

Data Management for Finance with Power Query

6 sessions 6/19 – 7/24

Financial Analysis & Ops Management

6-session program

Financial Analysis & Ops Management

6-session program

Cash Flow Mastery – Deep Dive Modeling – Level 2

8-session program

Cash Flow Mastery – Deep Dive Modeling – Level 2

8-session program

Holiday Break

Advanced Financial & Business Modeling

10-session program

Delivering Effective Financial Presentations

6-session program

Advanced Financial & Business Modeling

8-session program

Delivering Effective Financial Presentations

6-session program

Advanced Financial & Business Modeling

10-session program

FP&A Technical Fluency & Strategic Thinking

9-session program

FP&A Technical Fluency & Strategic Thinking

9-session program

Learn directly from Carl Seidman CPA | Microsoft MVP in a real-time, interactive format.

Go back to course content and recordings whenever you need to.

Download practical templates, reports, models, and work files you can use right away.

Stay accountable and share insights with like-minded professionals.

Share your new skills with your employer or on LinkedIn.

177 lessons • 20 projects

Tues. Oct 21 | 9am CST

📄 Cash Flow Modeling Best Practices | Structure

📄 Direct vs. Indirect Cash Flows

📄 Cash Flow Modeling Best Practices | Contents and Formulas

📄 Cash Flow Modeling Best Practices | Quality Review and Presentation

📄 Structuring the Cash Flow Forecast Model

📄 Getting the Timing Right: Accrual vs. Cash

📄 How the Financial Statements Connect and Relate

📄 Introduction to the Business Case

📄 Sourcing information from reports, statements and data

Fri. Oct 24 | 9am CST

📄 Modeling Sales and Cash Collections

✍️ Build Your Own Sales and Collections Forecast (Submit by May 13)

📄 Modeling Payroll, Benefits, Payroll Taxes, and Layoffs

📄 Modeling Direct Costs and Payments

📄 Modeling Inventory Categories

📄 Advanced Inventory Modeling (Raw Material | Work in Progress | Finished Goods)

📄 Modeling Direct Costs and Accounts Payable (A/P)

📄 Modeling Prepaid and Accrued Expenses

Tues. Oct 28 | 9am CST

📄 Modeling Indirect Operating Expenses

📄 Modeling Debt and Equity

📄 Modeling Capex / Fixed Assets

📄 Modeling Professional Fees

Fri. Oct 31 | 9am CST

📄 Modeling Financing Strategy with Excess Cash and Cash Flow Surpluses

📄 Modeling Financing Strategy with Cash Constraints and Cash Flow Deficits

📄 Modeling the Borrowing Base and Available Collateral for Short-Debt Financing

📄 Modeling the Revolving Line of Credit (LOC), Cash Needs, and Borrowing Base

📄 The Completed Cash Flow Model

Tues. Nov 4 | 9am CST

📄 Modeling Operating Improvements and Changes to Working Capital

📄 Reorganizing and Revitalizing the Business

📄 Reconciling Profitability to Cash (EBITDA-to-Cash Bridge)

📄 Integrations and Nuances in the Timing of Cash Flows

📄 13-Week Cash Flows, DIP Budgets, and Bankruptcy

Fri. Nov 7 | 9am CST

✍️ Capstone Business Case – Cash Flow Forecasting and Modeling (Submit by Nov. 14)

📄 Break for Capstone Business Case Completion

Tues. Nov 18 | 9am CST

📄 What is Microsoft Power Query and Why Does it Matter to Finance

📄 Dynamic Data Modeling Process Flow

📄 How Power Query and Financial Systems Interact

📄 When to Use Power Query vs. Excel

Fri. Nov 21 | 9am CST

📄 Data Acquisition Sources for Power Query

📄 Data Conversion Through Power Query

📄 Editing Power Query Parameters

📄 Power Query Editor – Intro to the Ribbons

📄 Power Query Editor – Home Ribbon

📄 Power Query Editor – Transform Ribbon

📄 Power Query Editor – Add Column Ribbon

📄 Data Connections via Power Query

📄 Introduction to Dynamic Tables

📄 Integration of Dynamic Tables with Power Query

📄 Financial and Business Modeling with Power Query and Data Tables

Tues. Dec 2 | 9am CST

📄 Intro to Data Modeling with Power Query

📄 Data Modeling – Establishing Tabular Relationships

📄 Data Modeling – Establishing Data Hierarchies

📄 Data Modeling – Data Relationship Directions

📄 Data Modeling – Cascading Data Flows

📄 Data Modeling – Viewing and Hiding Tabular Relationships

📄 Data Modeling Rules

Fri. Dec 5 | 9am CST

📄 Introduction to Data Analysis Expressions (DAX)

📄 Data Analysis Expressions (DAX) – Syntax and Rules

📄 Data Analysis Expressions (DAX) – Syntax and Rules

📄 Data Analysis Expressions (DAX) – Calculated Columns

📄 Data Analysis Expressions (DAX) – Measures

Tues. Dec 9 | 9am CST

📄 Introduction to Power Pivot

📄 How Power Pivot Compares/Contrasts with Traditional Pivot Tables

📄 Activating and Accessing Power Pivot

📄 Creating a Power Pivot Report

Thurs. Dec 11 | 9am CST

📄 Overlap Between Power Excel and Power BI

📄 How Power Query Integrates with Power BI

📄 Untitled lesson

✍️ Capstone Business Case: Build a Dynamic Data Flow Process (Submit by Dec. 12)

📄 Break for Capstone Business Case Completion

Tues. Jan 13 | 9am CST

📄 Introduction to 3-Statement Financial Modeling and Integrated Business Modeling

📄 3-Statement Financial Modeling (Corporate Finance vs. Investment Banking)

📄 Context is Key: Understanding Business/Client Objectives

📄 Understanding the Dynamics of the Business and its Industry

📄 🎯 INTRODUCTION TO THE BUSINESS CASE

📄 Modeling Skills Inventory: The Skills you Need and Those You Don’t

Fri. Jan 16 | 9am CST

📄 Initiating Document Requests: Information you Need and That Which You Don’t

📄 Document Requests: Financial Information

📄 Document Requests: Non-Financial Information

📄 Interviews of Key Personnel

Tues. Jan 20 | 9am CST

📄 Designing and Developing the Model at the Outset of the Project

📄 Model Formats and Layouts: Vertical Structure vs. Horizontal Structure

📄 Model Hygiene and Common Font Color Schemes

📄 Error Check Schedules and Conducting Quality Reviews

📄 Other Modeling Best Practices to Consider

Fri. Jan 23 | 9am CST

📄 Overview of the Financial Statements

📄 The Income Statement

📄 The Balance Sheet

📄 The Statement of Cash Flows – Indirect

📄 The Statement of Cash Flows – Direct

📄 Understanding the Key Connections Across the Financial Statements

📄 Accrual vs. Cash Impact

📄 Identifying Risks and Uncertainty Inherent in the Business and Model

📄 Overview of the Integrated Financial Statement Modeling Process

Tues. Jan 27 | 9am CST

📄 Overview of the Income Statement | Profit & Loss

📄 Review of the Historical Financials and What They Mean for the Forecast Model

📄 Identifying Revenue Drivers and Segmenting the Sales Forecast

📄 Driver-Based Forecasting: Industry Examples

✍️ Exercise: Forecasting Revenue (Submit by Jan 9)

📄 Identifying Cost Types and Drivers | Forecasting Direct Costs

✍️ Exercise: Forecasting Direct Costs (Submit by Jan 13)

📄 Forecasting General Overhead Expenses (SG&A)

✍️ Exercise: Forecasting Key SG&A Line Items (Submit by Jan 16)

Fri. Jan 30 | 9am CST

📄 Overview of the Balance Sheet

📄 Key Balance Sheet Roll-Forwards

📄 Accounts Receivable (A/R) Roll-Forward

📄 Days Sales Outstanding (DSO) and A/R Aging Analysis

✍️ Exercise: Accounts Receivable Roll-Forward (Submit by Jan 16)

📄 Inventory Roll-Forward

📄 Days Inventory Outstanding (DIO) | Days Inventory On Hand (DOH) Analysis

✍️ Exercise: Inventory Roll-Forward (Submit by Jan 16)

📄 Prepaid Expense Roll-Forward

📄 Accrued Payroll Roll-Forward

✍️ Exercise: Accrued Payroll Roll-Forward (Submit by Jan 16)

📄 Accrued Professional Expenses and Fees Roll-Forward

✍️ Exercise: Accrued Professional Fees Roll-Forward (Submit by Jan 16)

📄 Taxes Payable Roll-Forward

✍️ Exercise: Taxes Roll-Forward (Submit by Jan 16)

📄 Accounts Payable | Accrued Expenses Roll-Forward

📄 Days Payable Outstanding (DPO) Analysis

✍️ Exercise: A/P and Accrued Expenses Roll-Forward (Submit by Jan 16)

📄 Review of the Key Working Capital (WC) Accounts and Roll-Forwards

📄 Capital Expenditures (CapEx) and Fixed Assets Roll-Forward

📄 Intangible Assets Roll-Forward

✍️ Exercise: Fixed Assets and Intangible Assets Roll-Forward (Submit by Jan 16)

📄 Long-Term Debt Roll-Forward

✍️ Exercise: Long-Term Debt Roll-Forward (Submit by Jan 16)

Tues. Feb 3 | 9am CST

📄 Revisiting the 3-Statement Modeling Process

📄 Building the Statement of Cash Flows

✍️ Exercise: Building the Statement of Cash Flows (Submit by Aug 5)

Fri. Feb 6 | 9am CST

📄 Connecting the Financial Statements

📄 Modeling Plugs and Unknowns — Revolving Lines of Credit, Cash, Accrued Expenses

✍️ Exercise: Revolving Line of Credit Roll-Forward (Submit by Jan 23)

📄 Interest Expense Roll-Forward

✍️ Exercise: Interest Expense Roll-Forward (Submit by Jan 23)

📄 Completing the Integrated Financial and Business Model

Tues. Feb 10 | 9am CST

📄 Revisiting the 3-Statement Modeling Process

📄 Performing Quality Review and Error-Checks

📄 Limitations of the Financial Model

📄 Developing a Recurring Process for Updating the Model

Fri. Feb 13 | 9am CST

📄 Advanced Concepts in Integrated Financial and Business Modeling

📄 Borrowing Base Roll-Forward

✍️ Exercise: Borrowing Base Roll-Forward (Submit by Jan 27)

📄 The EBITDA-to-Cash Bridge: Reconciling Profitability with Liquidity

✍️ Exercise: EBITDA-to-Cash Bridge (Submit by Jan 27)

📄 Explaining Hits and Misses: Illustrating With Variances and Waterfalls

📄 Organizing the Model for Presentations

📄 Updating Operating Assumptions and Running Business Scenarios

✍️ Exercise: Actively Manage Costs and Expenses (Submit by Jan 27)

📄 Summary and Final Thoughts

✍️ Capstone Business Case: Advanced Financial and Business Modeling (Submit by Aug 15)

📄 Break for Capstone Business Case Completion

Tues. Mar 3 | 9am CST

📄 FP&A Business Modeling and Financial Modeling Best Practices

📄 FP&A Business Model Structure and Layout

📄 FP&A Modeling and the P.E.A.C.E. Framework

📄 FP&A Formula Auditing, Error-Checking, and Evaluation

📄 Monitoring and Tracking Updates and Changes

Fri. Mar 6 | 9am CST

📄 Introduction to Dynamic FP&A Business Modeling

📄 Dynamic Functionality in Enterprise Performance Management and Excel

📄 Dynamic Data Sets and Tables

📄 Dynamic Data Ranges and Formulas

📄 Dynamic Data, Pivot Tables and Slicers

📄 Dynamic Sparklines

📄 Dynamic FP&A Models in Practice

Tues. Mar 10 | 9am CST

📄 Introduction to Dynamic FP&A Business Modeling

📄 Dynamic Functionality in Enterprise Performance Management and Excel

📄 Dynamic Data Sets and Tables

📄 Dynamic Data Ranges and Formulas

📄 Dynamic Data, Pivot Tables and Slicers

📄 Dynamic Sparklines

📄 Dynamic FP&A Models in Practice

Fri. Mar 13 | 9am CST

📄 Resonating with the Intended Audience

📄 Managing Aesthetics, Presentation, and FP&A Model Components

📄 Enhancing User-Interface with Form Controls

📄 Presenting Dashboards, Waterfall Charts, and Executive Summaries

Tues. Mar 17 | 9am CST

📄 Sum of Worksheets Approach to Scenario Management (Excel)

📄 Multi-Dimensional Modeling Approach to Scenario Management (Excel)

📄 Scenario Manager Tool (Excel)

📄 Employing Sensitivity Analysis for Variable Inputs and Drivers

Fri, Mar 20 | 9am CST

📄 Methods in Forecasting, Budgeting, and Projetion

📄 Forecasting, Budgeting, and Projections for SMBs

📄 Techniques for Improving Forecast Accuracy

📄 Integrating Rolling Forecasts

📄 Modeling Risk, Uncertainty, Probability, and Impact

Tues. Mar 31 | 9am CST

📄 Quantifying the Value of Major Projects

📄 Determinations for Appropriate Investment and Maintenance Capex

📄 Measuring Cash Flow, Revenue Recognition, and Cost Allocations

Fri. Apr 3 | 9am CST

📄 FP&A Strategic Planning and Gap Analysis

📄 The Income Statement and Underlying Reporting

📄 Revenue and Cost Analysis

📄 The Balance Sheet and Underlying Reporting

📄 Working Capital Forecasting and Planning

📄 Cash Flows and Underlying Reporting

📄 Common-Sizing and Period-Over-Period Trend Analysis

📄 Liquidity Planning and Debt-Sizing

📄 Performance Optimization, Metrics, and Ratio Analysis

📄 Strategic Growth Planning and Profitability Enhancement

📄 Appraising the Business and Enhancing Value

📄 Course summary, reflections, wrap up, and next steps

✍️ Capstone Business Case: Build an FP&A Process Flow

Carl is a go-to FP&A development facilitator for Fortune 500s, mid-market companies, and entrepreneurial businesses. He is a Microsoft MVP (1 of just 35 US-based Excel MVPs) and one of the preeminent trainers and facilitators in strategic finance and FP&A, with more than 13,000 participants attending his financial training programs, seminars, workshops, and masterminds. Notable clients include:

ABM Industries, Accordion, AlixPartners, Allscripts, Broadridge, CHEP, Choice Hotels, CIBC, Cigna, Cox Enterprises, Crawford & Company, Deloitte, Dexcom, Discover, Dominium, Express Scripts, EY, FS Investments, EVRAZ, Genentech, Healthpeak, Heartland Financial, Hewlett Packard Enterprise, Hostess, IGT, KPMG, Marsh & McLennan, Michelin, NerdWallet, Radisson, Rapid7, Sol Petroleum, Spotify, Triple-S, Telus, Santander, United Technologies (RTX), UBT, Verizon, Walmart, and Workday.

Carl is masterful at making the complex amazingly simple, engaging his audiences, building confidence, and facilitating a welcoming and transformative group experience. His content is rich and relatable, used in financial leadership development programs (FLDPs) at Fortune 500 companies, and is utilized or licensed by 7 of the top global financial training companies.

Carl serves as an Adjunct Professor in data analytics at the Jones School of Business at Rice University. He is a Certified Public Accountant (CPA) has earned other professional credentials including the CIRA, CFF, CFE, CGMA, AM (Accredited Member in Business Valuation), CSP (Certified Speaking Professional), Certified Anaplan Model Builder, and was a National Association of Certified Valuators and Analysts (NACVA) 40 Under Forty honoree. He holds a BA in finance and economics and an MS in managerial accounting.

He’s been where you want to be and does the work you want to do.

Contact: info@seidmanfinancial.com

All sessions take place live. All sessions are recorded for future access, whether you miss a session or wish to revisit certain topics and discussions.

Because the FP&A Mastery Signature Program has a rolling curriculum, you may access recordings of prior live sessions.

Every live session is recorded so you can access it after it takes place.

Want to access to a live session and group discussion before it runs again? Get on-demand access to prior live cohort sessions any time you want.

Everything is at your fingertips.

Capstone projects are unveiled at the end of each course, at the conclusion of the final session. Attendees may attend office hours and are given 1 week to complete the project. Upon submission, attendees will receive coaching and feedback.

This course builds on live workshops and hands-on projects

No problem. While you are encouraged to attend live sessions — as a great part of the experience is both the live-reveals and the participant interaction — all sessions are recorded and may be accessed on your own time.

The experience is intentionally spaced out — 2 days each week over many weeks — so you can work your schedule around it.

There may be occasional pre-work and post-session work but it is minimal.

Because all sessions are recorded, you can revisit topics and discussions on your own schedule.

It is not customary for us to receive requests for refunds. However, if you are dissatisfied with your experience, please reach out to our customer service team so we can ensure you receive the value you expect.

I offer more than a dozen training programs and immersive development experiences across a wide range of finance and accounting topics.

Here are the other programs I offer.

This program is designed for finance professionals who want the most comprehensive, connected experience, community, and results.

We meet live on Zoom for 2 hours, 2x per week.

Each session consists of 1-2 learning topics and modules. Each module ties into prior and future modules, so it is important to try to avoid missing classes or watched recordings.

The structure of the session begins with an intro, a tie-in to a real example, exercises, discussion, and reflections.

Prerequisites for the course include the following:

No, but I will offer you my promises.

Everyone who attends this experience will have different backgrounds and aspirations which means they have different business models or jobs.

My promise is to share with you my techniques, tools, and processes that will accelerate your finance career and make you far more confident in what you do

Yes. You get all of the template models, clean and completed.

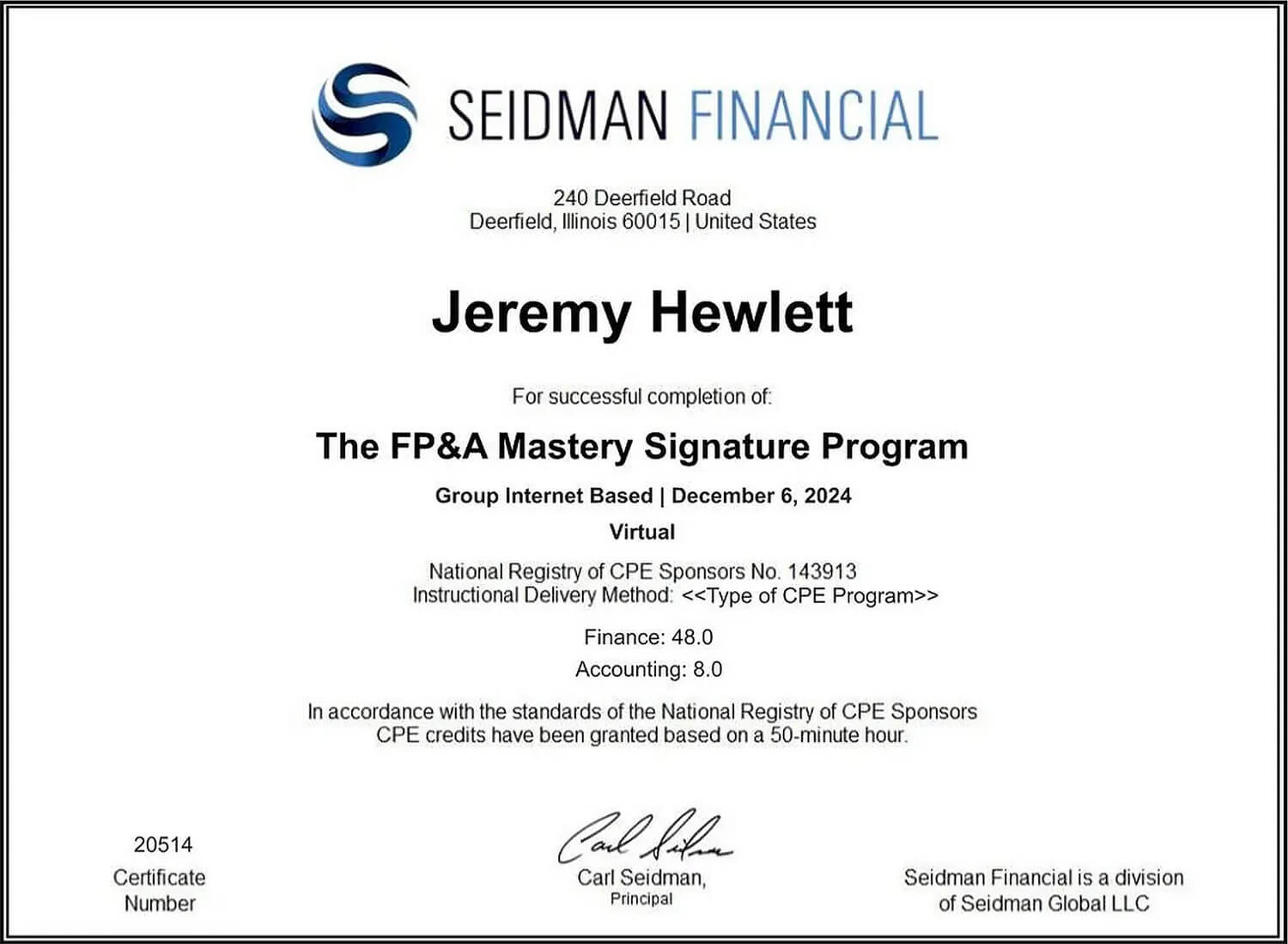

Yes, it qualifies for 56.0 CPE credits.

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit.

Most on-demand courses teach steps for plugging numbers into basic models. They don’t teach the nuances that you’re likely to encounter across a wide range of instances. And most course trainers don’t come from FP&A and CFO backgrounds.

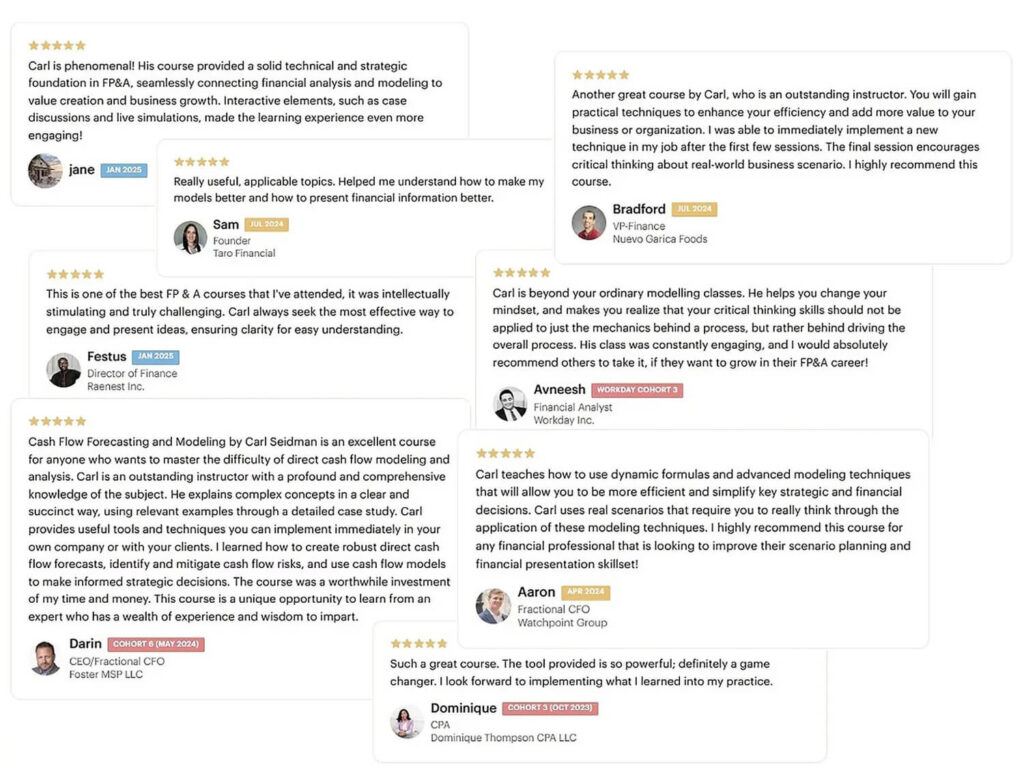

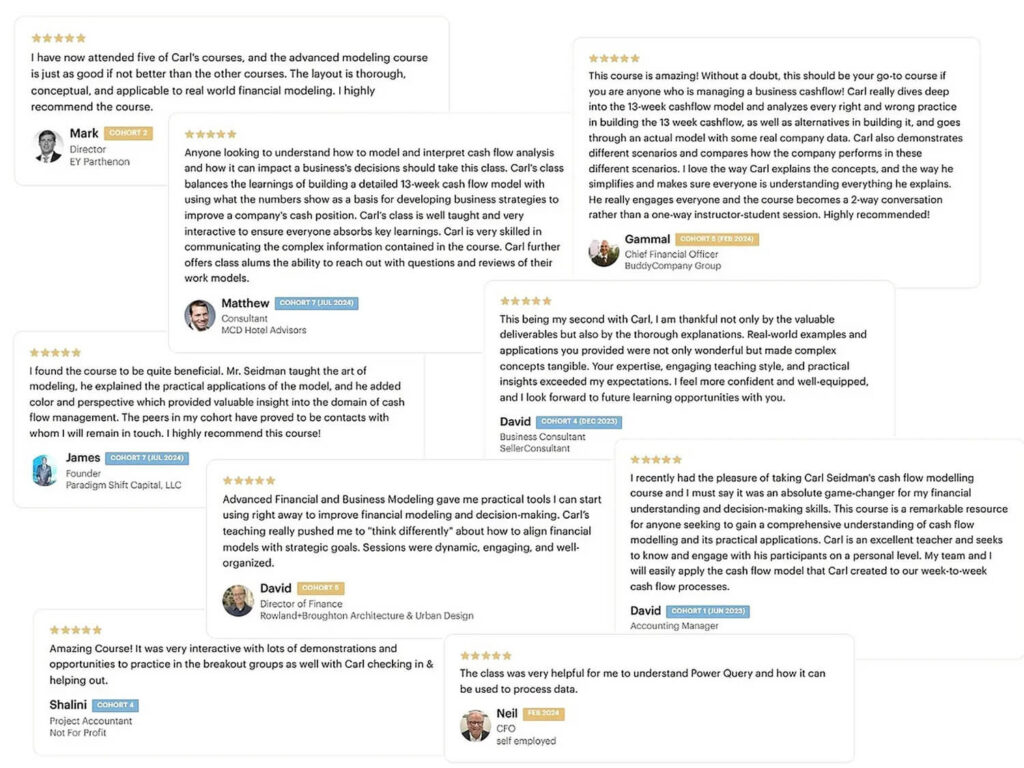

According to alumni, this is the best FP&A course curriculum available.

While students can enroll in any course individually, the FP&A Mastery Signature Program is designed as the most comprehensive, high-value, learning experience in the FP&A space.

Students are encouraged to get the most complete experience versus enrolling in each course one at a time.

Discount Applied Successfully!

Your savings have been added to the cart.