How Important are Financial Governance and Model Governance

Ten to fifteen years ago, I was a fraud examiner and forensic accountant. I was responsible for examining financial mischief. This included cash flow mismanagement, inventory manipulation, check kiting, and outright theft. When many of us think about governance in a traditional accounting sense, we think of it as internal controls, separation of duties, documentation of processes and procedures. Further, it has to do with custodianship of assets and safeguarding of data. All of this is still vitally important.

But today, we need to think about financial governance in a different way. I consider financial governance to be as much about data integrity, data flow, and data protection and control as it is about the traditional accounting definition. While financial analysts and managers may be the pilots on projects, and captains on FP&A teams, today, financial leaders and CFOs need to be in the control tower. They need to be able to have direct lines of communication to their individual FP&A team members. And they need to have direct lines of sight and oversight of the data that these teams, and others, rely upon.

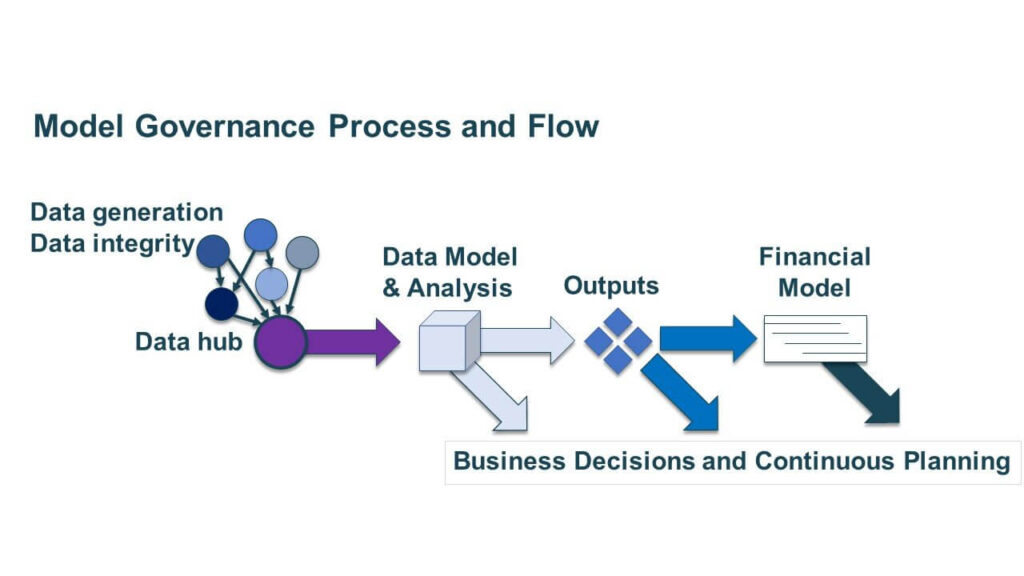

Peeling back the layers even more from financial governance, model governance is how we oversee and manage data connectivity and financial RELATIONSHIPS. It’s about ensuring we have strength and protection of data integrity, process and flow effectiveness, analysis, and model outputs. Recognize that all of these fall along a continuum, of procuring source information, getting it to the right people for analysis, and flushing it through synthesis for intelligence. It ultimately comes down to asking – what must we do and what must be in place to get the right information to the right people in the right format at the right time for effective-decision making and continuous planning.

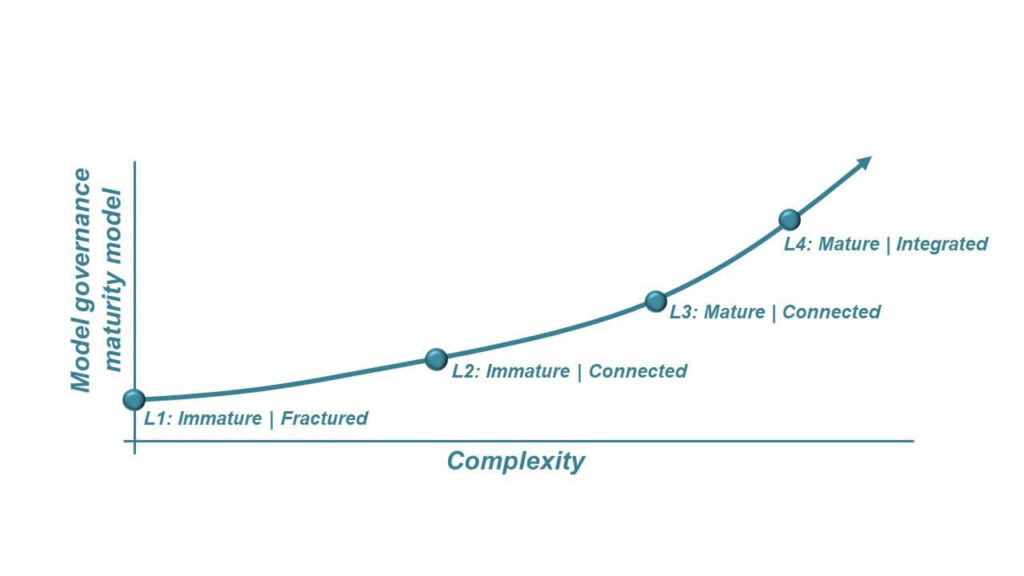

One of the areas of finance I’m most fascinated by is how practices vary between small private businesses, mid-sized companies and larger, international corporations. As companies grow in size and complexity, they require greater model governance. In its absence, the risks of erroneous decision-making skyrocket.

Seidman Financial Model Governance Maturity Model

In smaller businesses, I almost always find basic accounting systems, perhaps a separate inventory system, separate purchasing system, separate payroll system, et cetera. And then all of the information is brought together either piecemeal or though manually-driven exports into simplistic Excel models. I call this a level 1, immature, fractured model governance. Reason being, the data is contained in disparate platforms and not integrated. And the ability to get intelligence from data with integrity and effective process flow is highly compromised.

At level 2 model governance, as companies become more complex, they may still be immature as they grow. But they will likely pursue greater connectivity among their systems, allowing for queries and synchronizations that allow information to flow more effectively. We may or may not see EPM at this stage. The reason we still consider level 2 immature is that data is still disseminated across many platforms and with questionable data integrity.

At level 3, investment in connectedness and systems is far stronger. A data hub is ideally established, presenting a centralized and single source of truth. Systems can talk to each other and data can be easily queried and exported. We also likely see EPM in place allowing for financial models and intelligence to live outside of Excel.

Finally at Level 4, we see a fully integrated financial ecosystem, where data can be used by all groups, financial and non-financial and an ability to procure intelligence as desired and requested.

Model Governance Paradigm and Process Flow

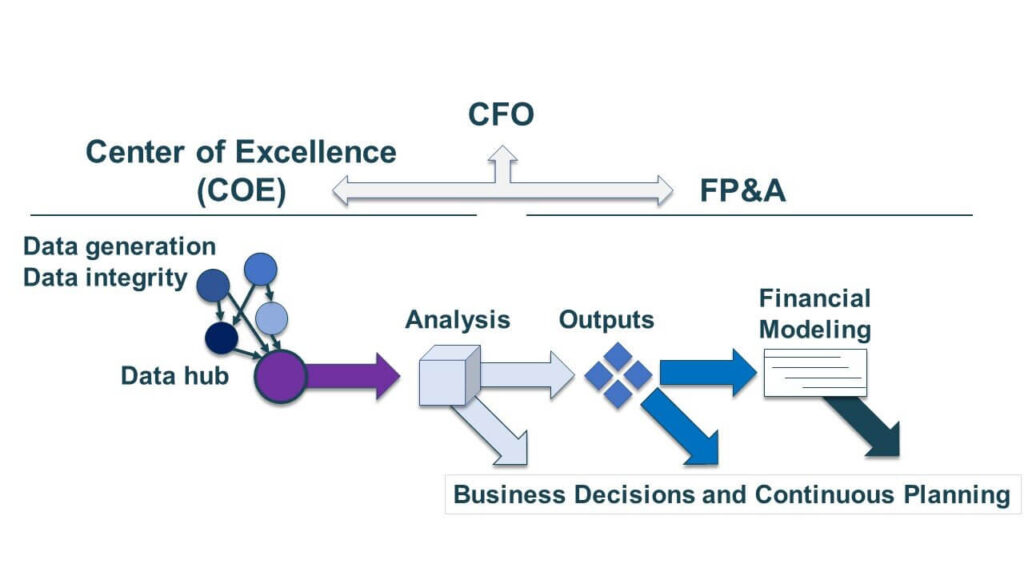

What CFO’s Need to Know about Financial Governance and Model Governance

Think back to the air traffic control tower analogy. CFOs in small businesses, in a Level 1 or Level 2 model governance, will likely be hands on with governance…if it even exists! In fact, if it does exist, they may be responsible for hands-on data and financial modeling. One of my clients is a CFO at a Level 1 small business and that describes him. But as companies go from a Level 2 to Level 3 to Level 4, the CFO will be less hands on but should still be expected to have oversight despite his or her elevation. To fill the void, model governance of individual points will partially fall to individual FP&A leaders while broad data and process oversight and custodial responsibility will fall to Center of Excellence. And both leadership groups will sit under the CFO umbrella.

In conclusion, model governance, in my opinion, comes down to 3 core traits – Declared ownership. We know who owns and is responsible for what. Defined processes and deliberate flow – we know how data integrity is maintained, how it’s utilized for analysis and translated into model outputs. Remember, model governance is about getting the right information, to the right people, in the right format, at the right time, for effective decisions and continuous planning. Model governance is how we make that a reality, time and time again, with consistence and confidence.