Is FP&A a Pathway to CFO?

The short answer to the question “is FP&A a pathway to CFO” is YES.

A recent Deloitte survey found that 47 percent of CFOs had at least some experience in FP&A before they landed their executive positions.

Of course, that doesn’t mean that everyone who starts their career in FP&A will end up as a CFO. There’s only one CFO in most companies, while there can be dozens or hundreds of people on an FP&A team.

But, if you have your eyes set on the position of CFO, FP&A is an excellent place to start.

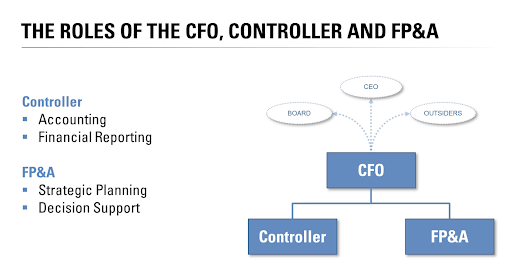

Understanding Reporting Structures in Traditional Organizations

In a standard organizational chart, the positions of FP&A and Controller usually both report to the CFO. While the Controller is responsible for accounting and financial reporting, FP&A focuses on strategic planning and decision support.

What Does a CFO Do?

The CFO is the top financial executive in an organization. In addition to being a financial expert, the CFO is a business strategist who can analyze financial data and make decisions about how the company should move forward.

Here are some of the key aspects of a CFO.

Reporting

The CFO almost always reports directly to the CEO. Additionally, the CFO likely reports to the Board of Directors and outside stakeholders, such as investors and lenders.

Forecasting

CFOs understand the ins and outs of the company’s financial performance. They know where the company has been, where it’s going, and what it needs financially and strategically to reach its objectives. In addition, CFOs are adept at forecasting and anticipation. He or she can make informed projections based on a company’s historical data, current circumstances, and future predictions.

Industry knowledge

CFOs need to possess more than just financial expertise. They should have significant industry and institutional knowledge to make decisions based on a larger context. This is crucial because the CFO tends to oversee major projects, expansions, and re-organizations.

Networking

A successful CFO has a robust network, including close relationships with lenders and investor groups. He or she may be part of a mastermind or peer groups of other CFOs. As the most senior of all financial professionals, there is an expectation of expertise and experience that comes from greater awareness of the industry, economy, and commercial sector.

Leadership

CFOs should have leadership experience. They oversee Controllers and Finance Directors along with FP&A and treasury functions. This means more than just technical expertise – it requires having a personal touch and ability to lead, direct, and manage teams. They should also have excellent presentation skills as well as written and verbal communication skills that makes this possible.

Additional skills

It doesn’t hurt for CFOs to have experience with fundraising, mergers and acquisitions (M&A), or corporate revitalization, especially if they work for a company that prioritizes transaction-driven growth or is experiencing a turnaround. The ability to think strategically, technically, and critically sets them uniquely apart as the financial captain of a larger crew.

How Working as FP&A Prepares You for the Role of CFO

Because CFOs need to be familiar with the Controller and FP&A roles, they likely have a background in one or both. However, key differences between the functions of Controller and FP&A make the latter a more likely path to CFO.

FP&A vs. Controller

Usually, both the FP&A and Controller teams report directly to the CFO. However, these two financial teams have different priorities.

The Controller or accounting team is responsible for duties like:

- Budgeting

- Compliance

- Taxes

- Record-keeping

- Accounts receivable/payable

In contrast, FP&A manages the strategic aspects of a company’s finance. A typical day for an FP&A professional might include:

- Strategic planning

- Business modeling

- Risk management

- Forecasting and projections

- External communications

- Transactions and M&A

As you can see, the position of CFO more closely aligns with the responsibilities of FP&A than those of a Controller or accounting. FP&A is closely tied to executing a company’s strategic plan and ensures that financial and operational decisions support that strategic plan.

Understanding the FP&A Reporting Structure

A typical organizational chart has multiple layers between the FP&A team and the CFO. Let’s walk through the various roles you might encounter on an FP&A team.

Head of FP&A

The FP&A function typically has a leader. That leader can go by different names, such as “Head of FP&A,” “Senior Vice President of FP&A,” or “Director of FP&A.” I even recently worked with a publicly-traded company with a “Global Head of FP&A.”

Don’t get hung up on the title. The main point here is that someone must be the leader of the FP&A team. That’s the person who reports directly to the CFO and manages the rest of the FP&A team. I’ll refer to this leader as Head of FP&A for our purposes.

The Head of FP&A reports directly to the CFO and gives them data analysis forecast models and data intelligence that supports other groups within the company. This is an excellent position for anyone who wants to be a CFO because it offers insight into a company’s financials and provides hands-on training for what it’s like to act as a CFO.

Senior FP&A leaders

Under the FP&A leader are several senior-level leaders who report directly to the Head of FP&A. What these leaders do will vary by company.

For example, there might be a senior FP&A leader who handles a specific customer channel of the business (e.g., a consumer segment.) In addition, there could be senior FP&A leaders for product channels, geographic regions, or functional roles where FP&A is deeply entrenched in a particular operating group (e.g., data analytics or procurement planning).

FP&A managers

FP&A managers are responsible for managing team members who execute tasks and processes within each segment of the FP&A team. They have experience in the individual tasks and processes and thus are in a position to oversee them. Managers commonly report to the senior FP&A leaders rather than to the CFO.

FP&A team members

These are the “boots on the ground” team members who execute the decisions made by FP&A managers and leaders. When first starting out with FP&A, this is likely where a new person will be. It’s a great place to get relevant experience, sharpen skills, and learn. In time, movement up the organizational chart occurs as valuable experience is gained, ultimately setting up opportunities for leadership roles.

Of course, not every company is structured this way, so every FP&A professional’s experience will be different and. Some organizational charts are more vertical, while others are flatter. Instead of worrying about a job title, focus should be on learning about the company and gaining industry and institutional knowledge to move up the hierarchy and become an FP&A leader.

Should You Pursue FP&A if You Want to be a CFO?

In short, yes. If your ultimate goal is to be the CFO of a company, then taking the FP&A path is an excellent way to get there.

As an FP&A professional, you will gain expertise in finance, strategy, analysis, industry, and institution, all of which are crucial for the role of CFO.

To learn more about what an FP&A does and how it can help you get to the role of CFO, enroll in my free course, The Role of the FP&A Professional in Today’s Environment.